News

Hundreds of Australian suburbs suffer double-digit rent hikes

Australia’s rental crisis has hit a fresh inflection point, with new figures showing more than 40 per cent of houses and units on the market have experienced double-digit price rises annually in May.

Data published by CoreLogic on Thursday revealed almost 1700 suburbs have recorded annual rental increases of 10 per cent or more, with prices up 0.8 per cent in May alone.

Just 6.7 per cent of the 3812 markets analysed by the firm had rent prices fall in the past year.

The rental surge is being blamed on a surge in overseas migration post-COVID and a shortfall in property listings, which are still 11 per cent lower than the five-year average, CoreLogic said.

But there are hopeful signs on the horizon, with the pace of rent growth in May below that of prior months, suggesting the market may be starting to cool slightly in the winter months.

Unfortunately that trend is being driven by regional Australia, not major cities where most live.

“Regional rental growth has slowed dramatically from a year ago while capital city rents were up 1.0 per cent in May,” CoreLogic economist Kaytlin Ezzy said on Thursday.

“When you break that figure down further by property type, we can see the unit sector is under the greatest pressure, with rents increasing at a faster rate than houses due to their relative affordability.”

Biggest rent hikes

Every capital in Australia has a vacancy rate lower than 1.5 per cent at the moment, which is helping to push up prices by forcing people to compete for a smaller number or properties.

The national vacancy rate was just a touch above its previous record low in May, rising from 1.1 per cent to 1.2 per cent, CoreLogic said.

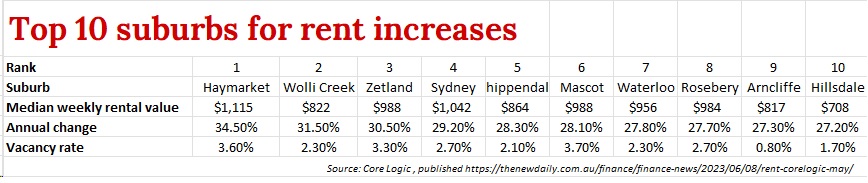

The biggest rent hikes are being suffered in Melbourne and Sydney, with suburbs like Haymarket, Wolli Creek and Zetland leading the way across Australia’s largest city.

Median weekly rents are now as high as $1115 in Sydney’s inner south, CoreLogic saidCore

Author: Matthew Elmas